Big Data Registered in Infographics

1 week ago •

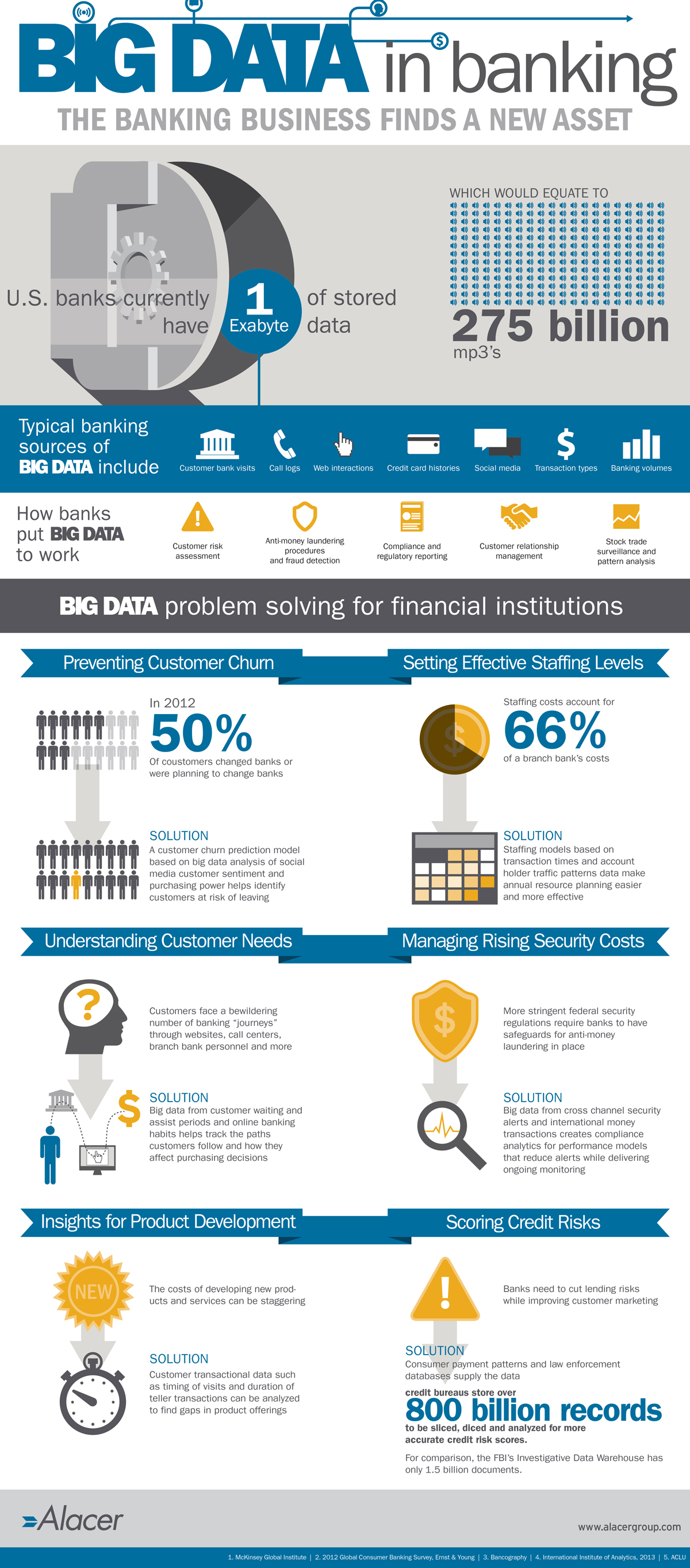

How banks put BIG DATA to work

CuMmr risk assessment

Anti-money launderingand procedures fraud detection

Compliance and regulatory reporting

Customer relationship management

surSvteoiciikantrcaedaend pattern analysis

BIG DATA problem solving for financial institutions

Preventing Customer Churn

In 2012

'MITT! 50% ttt Of coustomers changed banks or were planning to change banks

SOLUTION IMMIITTIFT A customer churn prediction model based on big data analysis of social e• • • • • • • • m dia customer sentiment and TrifTW purchasing power helps identify customers at risk of leaving

Understanding Customer Needs

Customers face a bewildering number of banking "journeys" through websites, call centers, branch bank personnel and more

SOLUTION Big data from customer waiting and assist periods and online banking habits helps track the paths customers follow and how they affect purchasing decisions

Insights for Product Development

Setting Effective Staffing Levels

Staffing costs account for

66%

of a branch bank's costs

SOLUTION Staffing models based on transaction times and account holder traffic patterns data make annual resource planning easier and more effective

Managing Rising Security Costs

The costs of developing new prod-ucts and services can be staggering

SOLUTION Customer transactional data such as timing of visits and duration of teller transactions can be analyzed to find gaps in product offerings

More stringent federal security regulations require banks to have safeguards for anti-money laundering in place

SOLUTION Big data from cross channel security alerts and international money transactions creates compliance analytics for performance models that reduce alerts while delivering ongoing monitoring

Scoring Credit Risks

Banks need to cut lending risks while improving customer marketing

SOLUTION Consumer payment patterns and law enforcement databases supply the data credit bureaus store over 800 billion records

to be sliced, diced and analyzed for more accurate credit risk scores.

For comparison, the FBI's Investigative Data Warehouse has only 1.5 billion documents.

Related content

Infographic : Big Data is Big Business in Banking #Infographic #Business #big_data

1 week ago

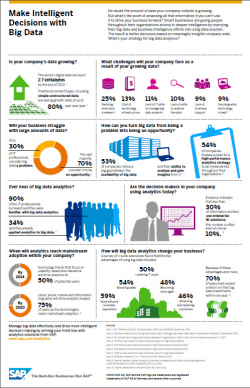

Infographic : Make Intelligent Decisions With Big Data #Business #Infographic

1 week ago

INFOGRAPHIC: Big Data is Big Business #Infographic #business #big_data

1 week ago

infographic : Business infographic : The 8 v's of #Big_data i#nfographic #Business

1 week ago

Infographic: Why Big Data Keeps #Big_data #infographic

1 week ago